Should I Move with Today’s Mortgage Rates?

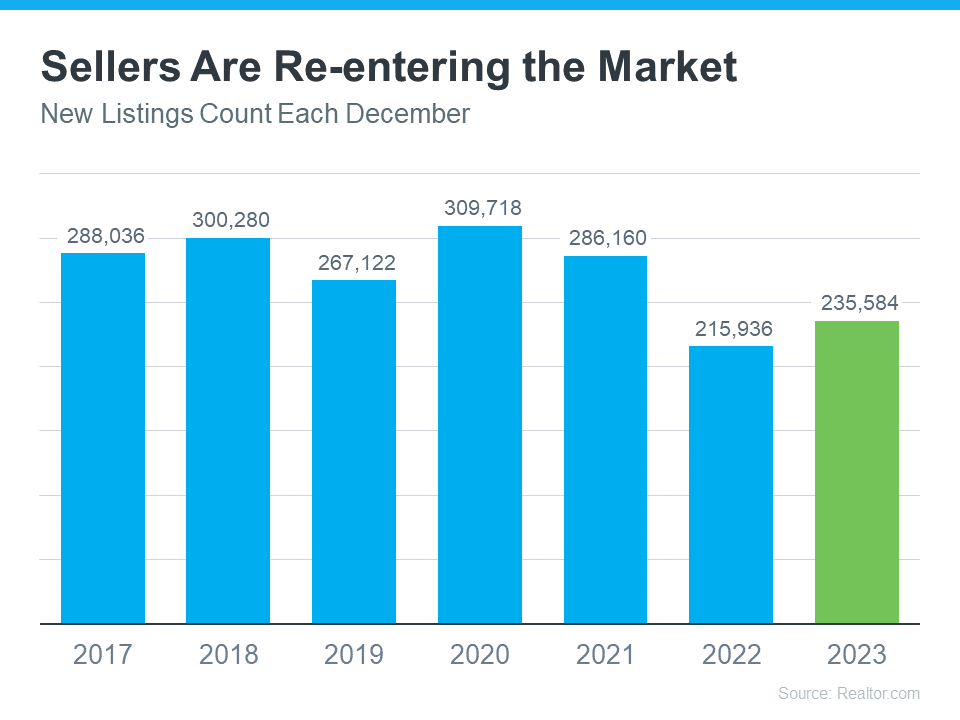

Should I Move with Today’s Mortgage Rates? When mortgage rates spiked over the last few years, some homeowners put their plans to move on pause. Maybe you did too because you didn’t want to sell and take on a higher mortgage rate for your next home. But is that still the right strategy for you? In today’s market, data shows more homeowners are getting used to where rates are and thinking it may be time to move. As Mark Zandi, Chief Economist at Moody’s Analytics, explains: “Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.” A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual below): What Would Motivate You To Move? Now that you know why other people would move, take a minute to think about what would make a move worth it for you. Is it time to take a chance and go for your dream job, even though it’s not local? Are you looking for a neighborhood that has more to offer and a close-knit sense of community? Maybe you just need more space, you’re looking for your next great adventure, or you want a house that opens up rental opportunities to pad your income. And here’s something else to consider. Mortgage rates are still expected to go down over the year. And once that happens, there’s going to be a big rush of buyers jumping back into the market. While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do. So, does that mean it’s worth it to move now, even with rates where they are? The answer is: that it depends. You'll want to consider today’s mortgage rates, where they’re expected to go from here, and what would prompt you to want to make a change as you decide on your next steps. An expert can help with that. Bottom Line Other homeowners are getting used to rates and deciding to move. Let’s chat to go over what matters most to you and if it’s time for you to jump back into the market too.

Read More

Buying a Home in 2024

2024 is just around the corner, and for those looking to buy a new home, it's a year filled with excitement, opportunities, and changing trends. As we dive into the world of real estate, let's explore what buyers can expect, the latest real estate news, and how the ever-evolving lifestyle trends impact the home-buying experience.First and foremost, let's take a closer look at buyers in 2024. With increasing technological advancements and the rise of remote work, the real estate market is experiencing a shift in demographics. Millennials, who have long been considered the largest group of homebuyers, are now reaching their peak buying age, making up a significant portion of the market. Additionally, we're witnessing a surge in Generation Z buyers, as this younger generation starts to enter the workforce and establish their own households.The preferences of these new buyers are also changing. Sustainability and energy efficiency are no longer just buzzwords; they have become essential factors in the decision-making process. In 2024, buyers are more likely to prioritize homes with eco-friendly features, such as solar panels, energy-efficient appliances, and smart home technology. These features not only reduce environmental impact but also help save on utility bills, making them attractive options for budget-conscious individuals.Now, let's turn our attention to the latest real estate news. In 2024, the market remains strong, despite a few fluctuations. With the continuous growth of urban centers, suburban areas are becoming increasingly popular. People are looking for homes with more space, both indoors and outdoors, as they prioritize comfortable living arrangements and a connection with nature. As a result, real estate developers are responding to this demand by creating communities that offer a balance between urban conveniences and suburban tranquility.Moreover, the real estate industry is also embracing technology to provide buyers with more accessible and immersive experiences. Virtual reality tours allow potential buyers to explore properties from the comfort of their own homes, saving time and effort. Additionally, blockchain technology is becoming more prevalent in real estate transactions, providing a secure and transparent platform for buying and selling properties.Lastly, let's consider how lifestyle trends influence the home-buying experience in 2024. As remote work becomes more commonplace, homebuyers are seeking properties that accommodate a hybrid lifestyle, where working, living, and enjoying leisure activities can seamlessly coexist. Homes with designated office spaces, outdoor living areas, and versatile layouts are highly sought after, as they provide the flexibility needed to adapt to changing lifestyles.Furthermore, health and wellness have taken center stage in recent years, and it's no different when it comes to home buying. In 2024, buyers are looking for properties that prioritize wellness amenities such as fitness centers, walking trails, and green spaces. The pandemic has made people more aware of the importance of a healthy living environment, and homes that support physical and mental well-being are gaining popularity.In conclusion, buying a home in 2024 offers an array of opportunities and trends to consider. With changing demographics, a focus on sustainability, technological advancements, and a desire for a balanced lifestyle, buyers can expect an exciting and evolving real estate market. Whether you're a millennial, a Gen Z buyer, or someone looking to embrace the latest lifestyle trends, the home you purchase in 2024 will undoubtedly cater to your needs and aspirations.

Read More

3 Key Factors Affecting Home Affordability

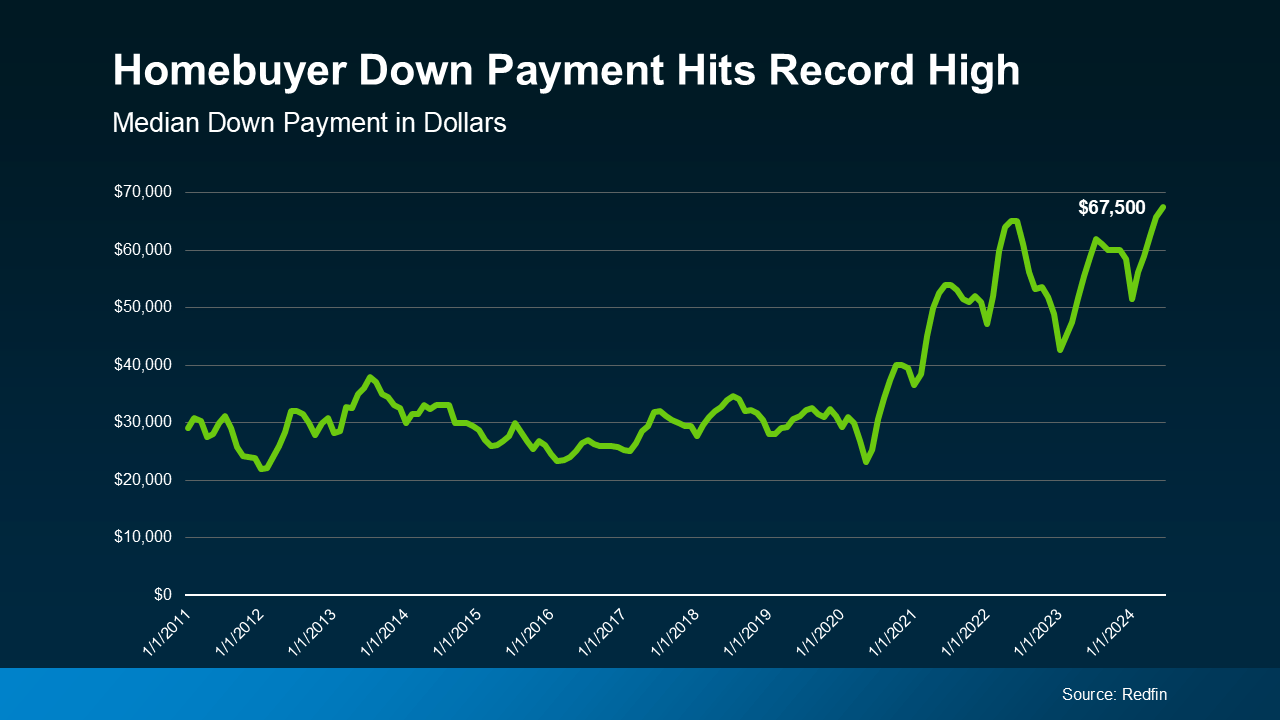

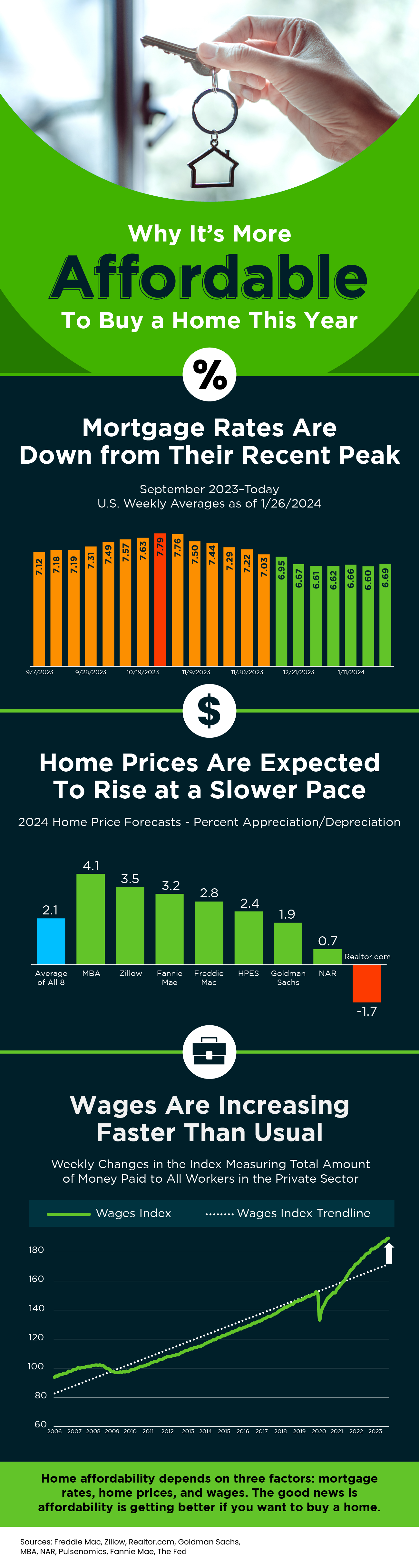

Over the past year, a lot of people have been talking about housing affordability and how tight it’s gotten. But just recently, there’s been a little bit of relief on that front. Mortgage rates have gone down since their most recent peak in October. But there’s more to being able to afford a home than just mortgage rates. To understand home affordability, you need to look at the combination of three important factors: mortgage rates, home prices, and wages. Let’s dive into the latest data on each one to see why affordability is improving. 1. Mortgage Rates Mortgage rates have come down in recent months. Looking forward, most experts expect them to decline further over the year. Jiayi Xu, an economist at Realtor.com, explains: “While there could be some fluctuations in the path forward … the general expectation is that mortgage rates will continue to trend downward, as long as the economy continues to see progress on inflation.” Even a small change in mortgage rates can have a big impact on your purchasing power, making it easier for you to afford the home you want by reducing your monthly mortgage payment. 2. Home Prices The second important factor is home prices. After going up at a relatively normal pace last year, they’re expected to continue rising moderately in 2024. That’s because even with inventory projected to grow slightly this year, there still aren’t enough homes for sale for all the people who want to buy them. According to Lisa Sturtevant, Chief Economist at Bright MLS: “More inventory will be generally offset by more buyers in the market. As a result, it is expected that, overall, the median home price in the U.S. will grow modestly . . .” That’s great news for you because prices aren’t likely to skyrocket like they did during the pandemic. But it also means it’ll probably cost you more to wait. So, if you’re ready, willing, and able to buy, and you can find the right home, purchasing before more buyers enter the market and prices rise further might be in your best interest. 3. Wages Another positive factor in affordability right now is rising income. The graph below uses data from the Federal Reserve to show how wages have grown over time: Looking at the blue-dotted trendline, you can see the rate at which wages typically rise. But on the right side of the graph, wages are above the trend line today, meaning they’re going up at a higher rate than normal. Higher wages improve affordability because they reduce the percentage of your income it takes to pay your mortgage. That’s because you don’t have to put as much of your paycheck toward your monthly housing cost. What This Means for You Home affordability depends on three things: mortgage rates, home prices, and wages. The good news is, they’re moving in a positive direction for buyers overall. Bottom Line If you're considering buying a home, it's important to know that the main factors impacting affordability are improving. To get the latest updates on each, let's connect.

Read More

Categories

Recent Posts